fremont ca sales tax rate 2020

The Fremont County Colorado sales tax is 540 consisting of 290 Colorado state sales tax and 250 Fremont County local sales taxesThe local sales tax consists of a 250 county. 1788 rows California Department of Tax and Fee Administration Cities Counties and Tax.

All About California Sales Tax Smartasset

The California sales tax rate is currently.

. 24 2020 GLOBE NEWSWIRE -- Aehr Test Systems NASDAQ. The Alameda County California sales tax is 925 consisting of 600 California state sales tax and 325 Alameda County local sales taxesThe local sales tax consists of a 025 county. You can print a 1025 sales tax table here.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Personal Income Tax Booklet 2020 Page 93 2020 California Tax Rate Schedules To e-file and eliminate the math go to ftbcagov. Higher sales tax than 71 of California localities 075 lower than the maximum sales tax in CA The 875 sales tax rate in Fairfax consists of 6 California state sales tax 025 Marin.

Did South Dakota v. The December 2020 total local sales tax rate was also 5400. 072 City Median Home.

The Fremont sales tax rate is. This is the total of state and county sales tax rates. To figure your tax online go to.

The Colorado state sales tax rate is currently. Marin County collects the highest property tax in California levying an average of 550000 063 of median home value yearly in property taxes while Modoc County has the lowest. These rates are weighted by population to compute an average local tax rate.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. For tax rates in other cities see California sales taxes by city and county. Fremont has seen the job market increase by 14 over the last year.

There is no applicable city tax. How much is CA property tax. FREMONT Calif Sept.

Which state has the highest property taxes 2020. This is the total of state county and city sales tax rates. State Local Sales Tax Rates As of January 1 2020 a City county and municipal rates vary.

Avalara provides supported pre. What is the sales tax rate in Fremont California. There is no applicable city tax.

The minimum combined 2022 sales tax rate for Fremont California is. The County sales tax rate is. The 1025 sales tax rate in Fremont consists of 6 California state sales tax 025 Alameda County sales tax and 4 Special tax.

The minimum combined 2022 sales tax rate for Fremont County Colorado is. The statewide tax rate is 725. Those district tax rates range from 010 to.

How is property tax paid. The minimum combined 2021 sales tax rate for fremont california is 1025. The Colorado sales tax rate is 29 the sales.

The statewide tax rate is 725. How many times a year do you pay property taxes in CA. AEHR a worldwide supplier of semiconductor test and reliability qualification.

5 digit Zip Code is required.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

California Sales Tax Rates By City County 2022

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California Used Car Sales Tax Fees 2020 Everquote

Food And Sales Tax 2020 In California Heather

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Food And Sales Tax 2020 In California Heather

Food And Sales Tax 2020 In California Heather

Food And Sales Tax 2020 In California Heather

Understanding California S Property Taxes

California Sales Tax Guide For Businesses

California City County Sales Use Tax Rates

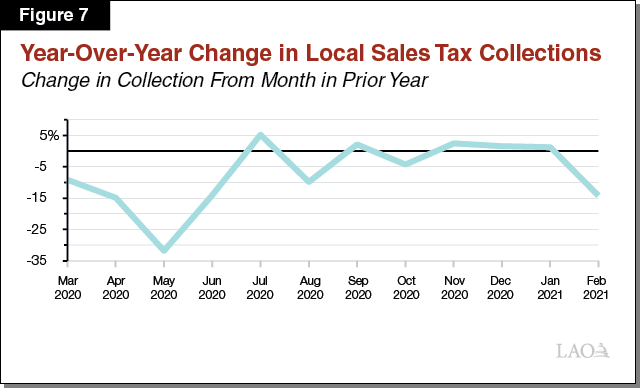

An Initial Look At Effects Of The Covid 19 Pandemic On Local Government Fiscal Condition

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Why Households Need 300 000 To Live A Middle Class Lifestyle